First Mate McConnell: “Cap’n the ship is headed straight for that iceberg and there’s no way we kin stop her in time!”

Boehner: “Don’t worry mate. I have a plan.”

FM McConnell: “What kin we do?”

Capt. Boehner: “Open all the bilges. We’ll sequester sea water!”

FM McConnell: “Cap’n that’ll sink the ship.”

Capt. Boehner: “And the iceberg will be averted.”

FM McConnell: “Genius! Pure genius!”

If you don’t know about monetary precipices the “fiscal cliff” is where we, as a nation, are headed on December 31, 2012 if Congress can’t, as they couldn’t last year, come to terms about how to correct our course of deficit and right the ship of state. If nothing changes, at midnight Dec. 31, 2012 the terms of the Budget Control Act of 2011 will go into effect. Besides an end to Bush era tax cuts, the Budget Control Act calls for spending cuts (sequestration) to more than 1,000 government programs.

National parks, national forests, the Land and Water Conservation Fund, EPA and NOAA are just a few of the environmental agencies that will suffer from rolling over the fiscal cliff. The Natural Resources Defense Council has a download that points out concerns of numerous environmental watchdog organizations: http://switchboard.nrdc.org/blogs/sslesinger/when_congress_comes_back_from.html

Some highlights from the list include; closing of national park service campgrounds and visitor centers, plus the loss of Park Rangers. The National Wildlife Refuge system could see the loss of 200 or more science jobs plus a reduction in law enforcement personnel. National forests will see trail closures and less capacity for wildfire control. The Environmental Protection Agency as well as the National Oceanic and Atmospheric Administration will be sorely hamstringed when it comes to research and/or enforcement. Things like clean air – clean water – and healthy, safe recreational opportunities will once again be put on the back burners.

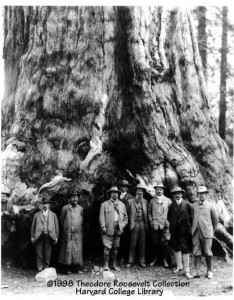

If that grand ole Republican, Teddy Roosevelt, could, indeed, loose his bronze steed from the steps of the New York Museum of Natural History a’la “A Night at the Museum” he would undoubtedly be charging the Hill to avert the “fiscal cliff.” Roosevelt was a dedicated conservationist. He created five national parks and 150 national forests. He also passed the Antiquities Act, which allows the government to protect areas and/or objects of historical, natural and/or scientific significance as national monuments. All of these parks, forests and monuments are dead in the crosshairs of hefty funding cuts.

Of course, many other policies like defense cuts are also being pushed to the precipice. Payroll tax cuts, tax breaks for businesses and tax breaks for the wealthiest Americans are set to expire. The lynchpin in negotiations appears to be an increase (or the expiration of the Bush cuts) in tax on America’s wealthiest citizens. Republican Speaker of the House Boehner, minority whip McConnell and most of the other Republicans who signed an oath to Grover Norquist and the Americans for Tax Reform vowing to never raise taxes for any reason say any kind of tax hike is out of the question. The Obama Administration and supporters say that some kind of tax increase on the wealthy has to be part of the package. And what are these draconian Machiavellian tax increases Mr. Obama wants to impose? Basically letting the Bush tax cuts for the wealthiest one percent or so of Americans expire. Today the top .1 percent of households in America are paying a tax rate that is roughly half of what they were paying in 1960. And anything more, according to today’s Republican banner-carriers is simply socialism and/or class warfare.

“The only reason Democrats are insisting on raising rates is because raising rates on the so-called rich is the holy grail of liberalism.” according to McConnell.

“Raising tax rates is unacceptable…Frankly it [tax increase on the wealthy] couldn’t even pass the House. I’m not sure it could pass the Senate.”

Compare that to Roosevelt: “The man of great wealth owes a peculiar obligation to the State, because he derives special advantages from the mere existence of government. Not only should he recognize this obligation in the way he leads his daily life and in the way he earns and spends his money, but it should also be recognized by the way in which he pays for the protection the State gives him.”